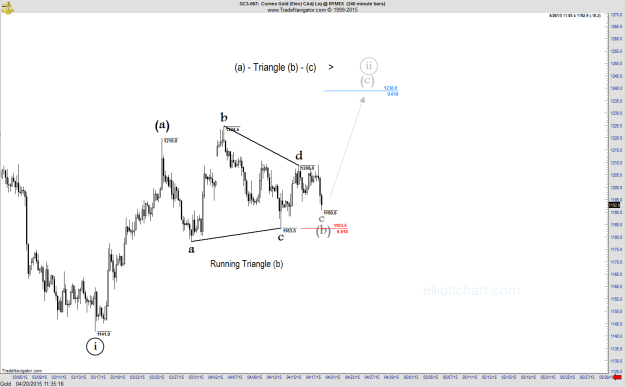

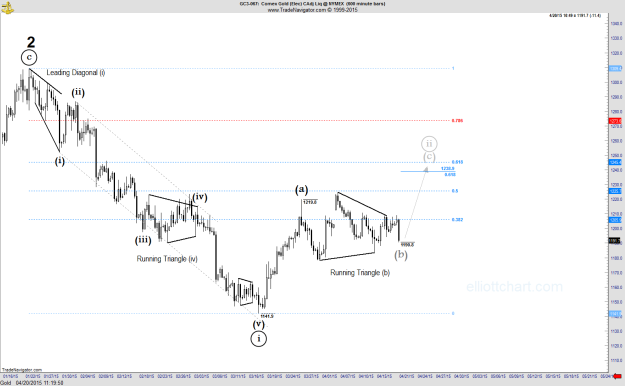

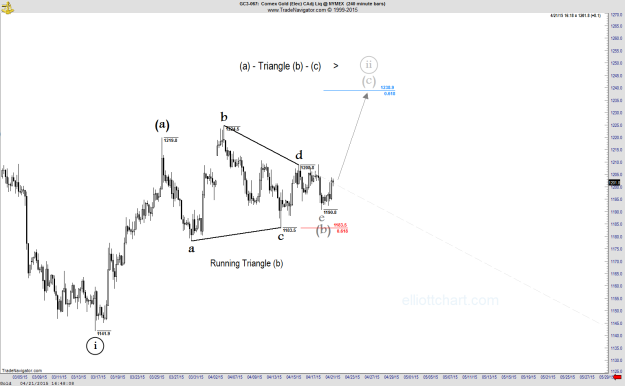

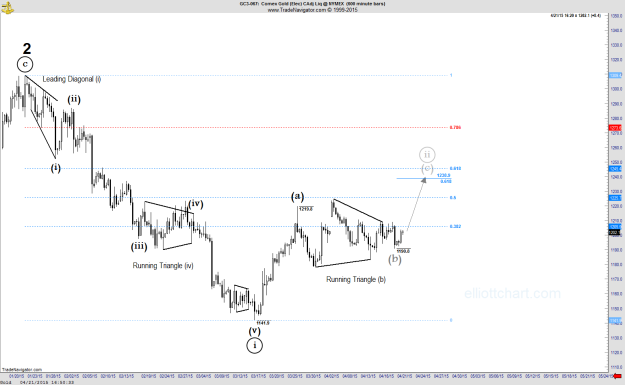

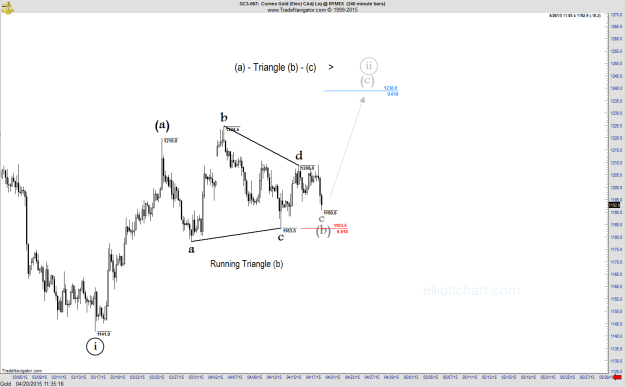

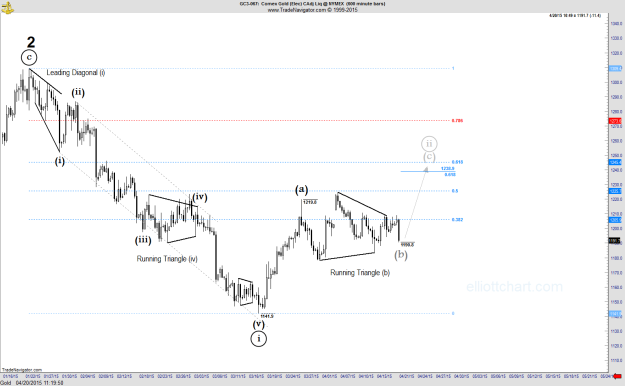

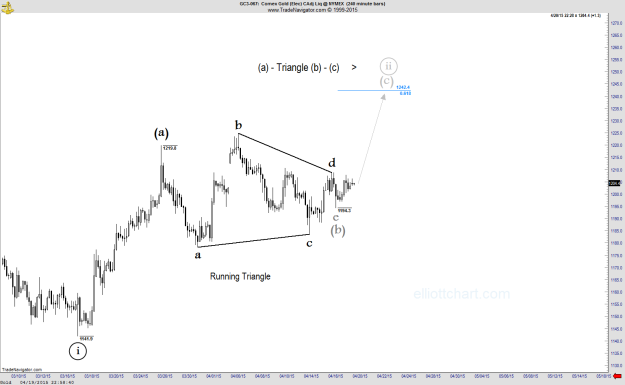

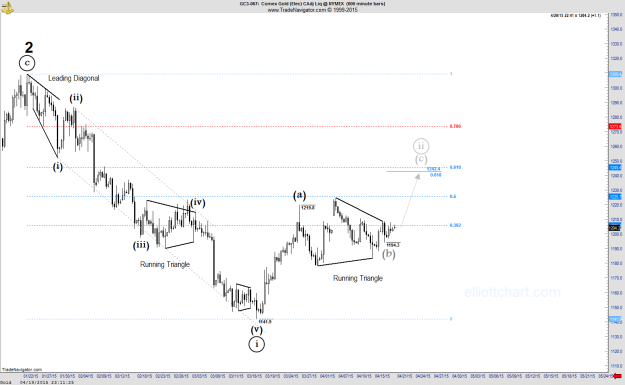

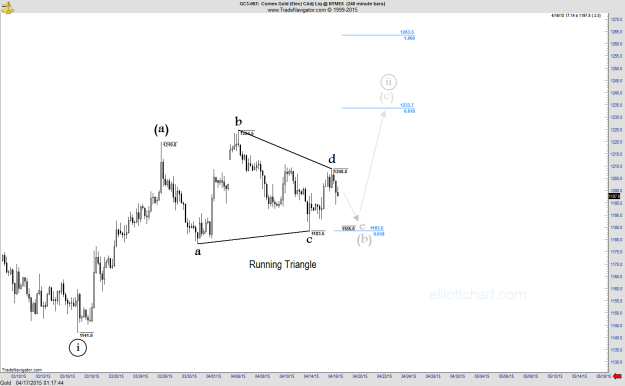

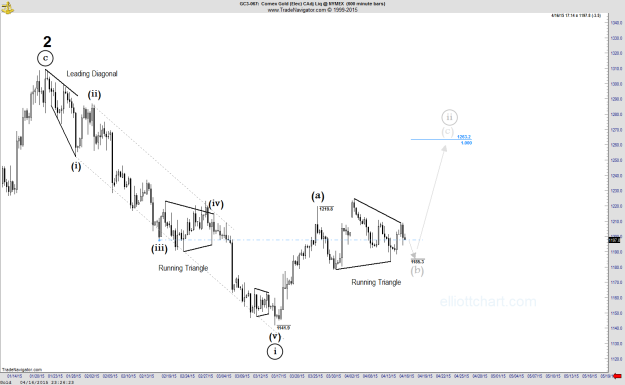

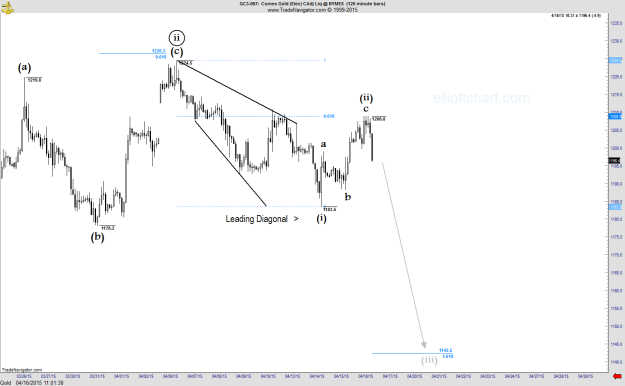

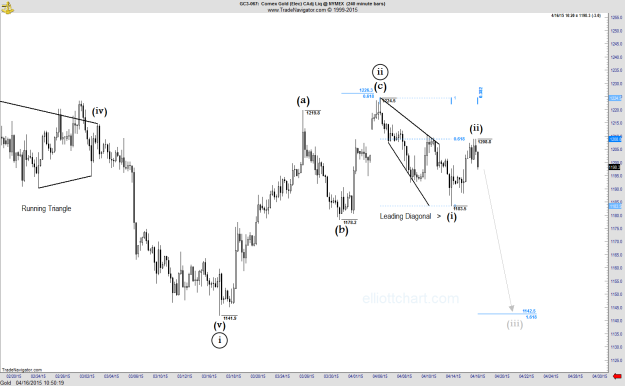

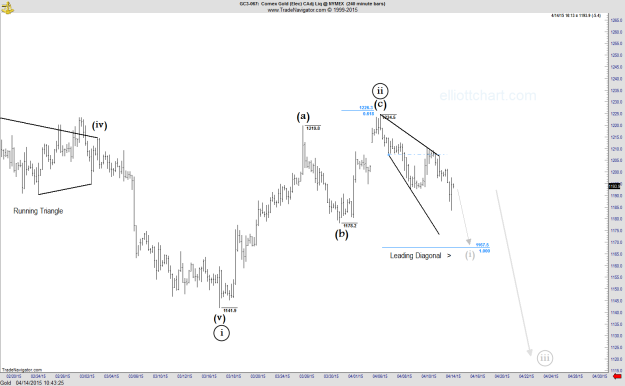

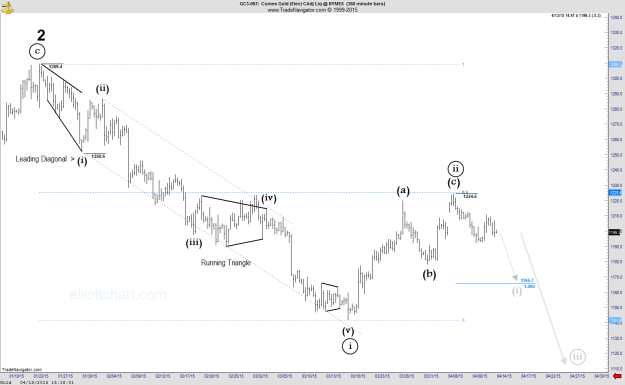

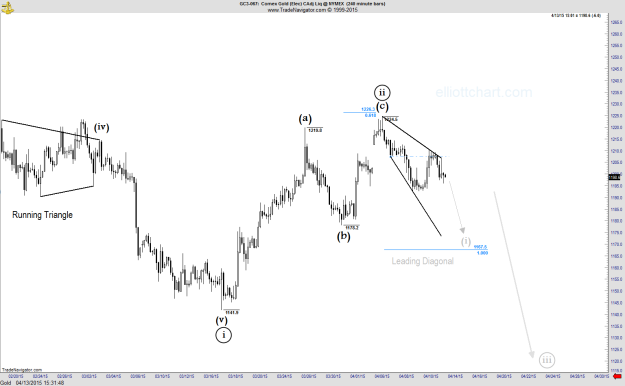

Gold may be completing the latest wave of the running triangle (b) at the current levels. The ultimate target for ongoing wave e is 1183.5, where is the extreme point of the wave c of the same triangle. The outlook is bullish against the 1183.5, in SHORT term!

Note : The level of 1183.5 could be considered as a “Red line” on this pattern. Because, wave e of a triangle pattern never moves beyond the end of wave c.

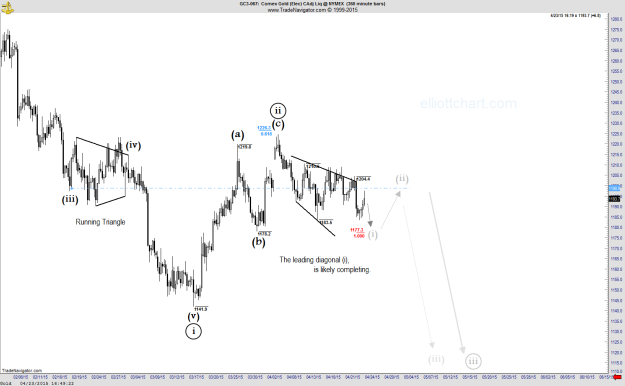

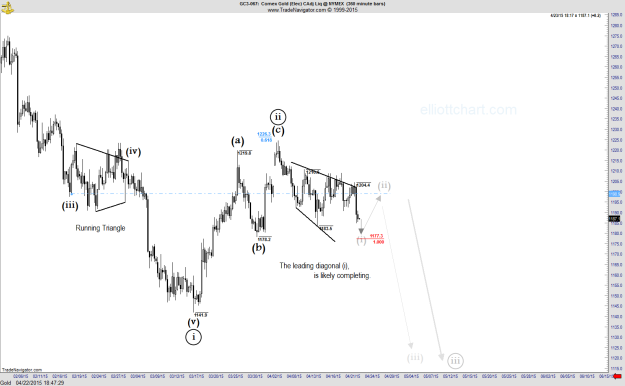

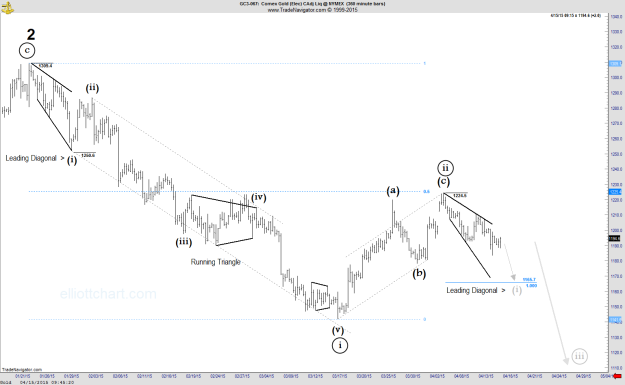

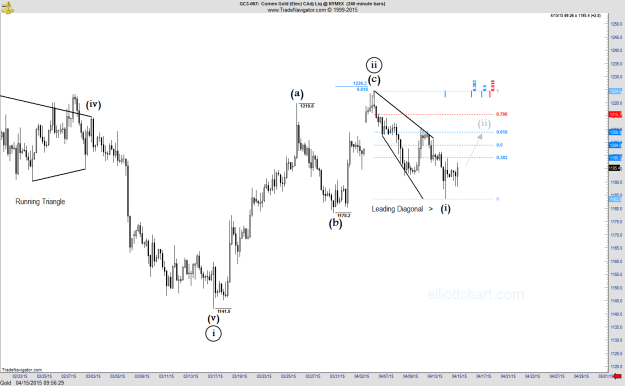

Contracting Triangle:

“A triangle appears to reflect a balance of forces, causing a sideways movement that is usually associated with decreasing volume and volatility. The triangle pattern contains five overlapping waves that subdivide 3-3-3-3-3 and are labeled A-B-C-D-E.”

As a rule about “Contracting Triangle” in Elliott Wave Principle :

” Wave C never moves beyond the end of wave A, wave D never moves beyond the end of wave B, and wave E never moves beyond the end of wave C. The result is that going forward in time, a line connecting the ends of waves B and D converges with a line connecting the end of waves A and C.”