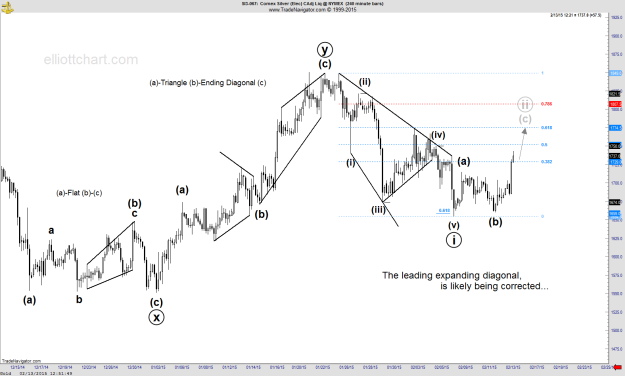

According to the bearish expectations:

Under the bearish alternate view, Silver has completed the leading expanding diagonal as a bearish concept at terminus point of 16.54 , and now the pattern is probably being corrected. The rise from the last low of 16.54 appears to be a corrective move. Hence, on this ongoing corrective sequence, the waves (a) and (b) of a possible “Expanded Flat” could have been completed, and wave (c) is likely in progress…

How far up can the ongoing correction be expected to go?

” A leading diagonal in the wave one position is typically followed by a deep retracement.” Based on the guideline, it’s expected the diagonal would retrace to the fibo-retracement level of 0.618 at 17.74 .

And eventually, the leading diagonal formation as a motive five-waves sequence down from recent high at 18.49, would raise confidence that the trend has turned down.

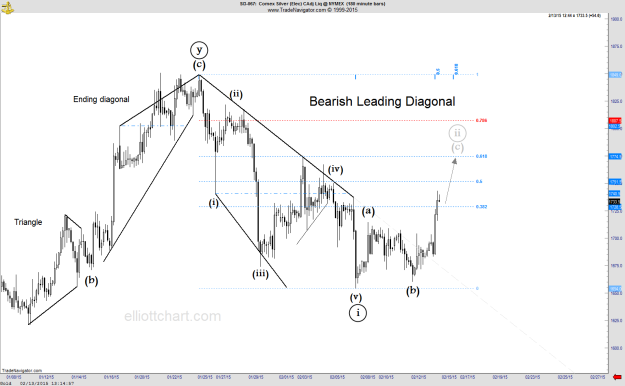

Accordance with the Elliott Wave Principle:

” A leading diagonal can also take an expanding shape. This form appears to occur primarily at the start of declines… ”