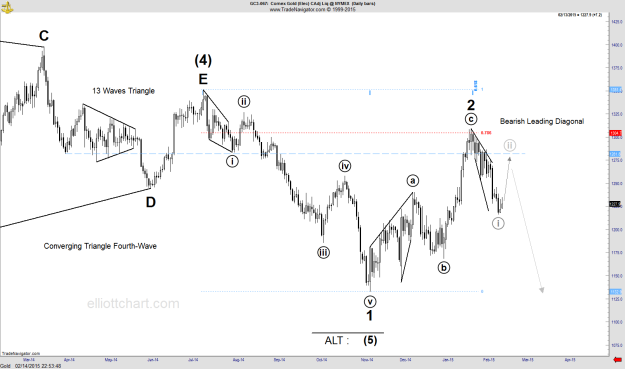

The bearish alternative :

On the bearish alternate view on the daily chart frame, after completing the converging triangle wave (4) at terminus point of 1352, Gold fell down in the five-waves sequence which could be first wave of wave (5), and the rise up from low of 1133 through last peak at 1309, that it could be corrective wave 2 .

Currently, it appears that a bearish leading diagonal formation, as the initial subsequent of decline ahead, could be completed and it’s likely being corrected. Hence, forming the five-waves sequence down and then its three-wave correction up, conceptually would indicate the turn to downside in a persistent trend.

A bullish alternative :

Under a bullish alternate view on the daily chart, Gold after completing the converging triangle wave (4), could be completed the five-waves sequence down as the overall wave (5), and hence the bottom at 1133 could be the terminus point of the wave (5) .

Not: Forming a five-waves sequence up, would raise confidence that trend has turned up, and bullishness will likely to dominate over the coming weeks.